Last update 04 Jan 2025

SC276

Last update 04 Jan 2025

Overview

Basic Info

Drug Type Universal CAR-T |

Synonyms SC 276, SC-276, SC276 |

Target |

Mechanism CD19 inhibitors(B-lymphocyte antigen CD19 inhibitors), CD22 inhibitors(CD22 inhibitors) |

Therapeutic Areas |

Active Indication- |

Inactive Indication |

Originator Organization |

Active Organization- |

Inactive Organization |

Drug Highest PhaseDiscontinuedPreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with SC276

Login to view more data

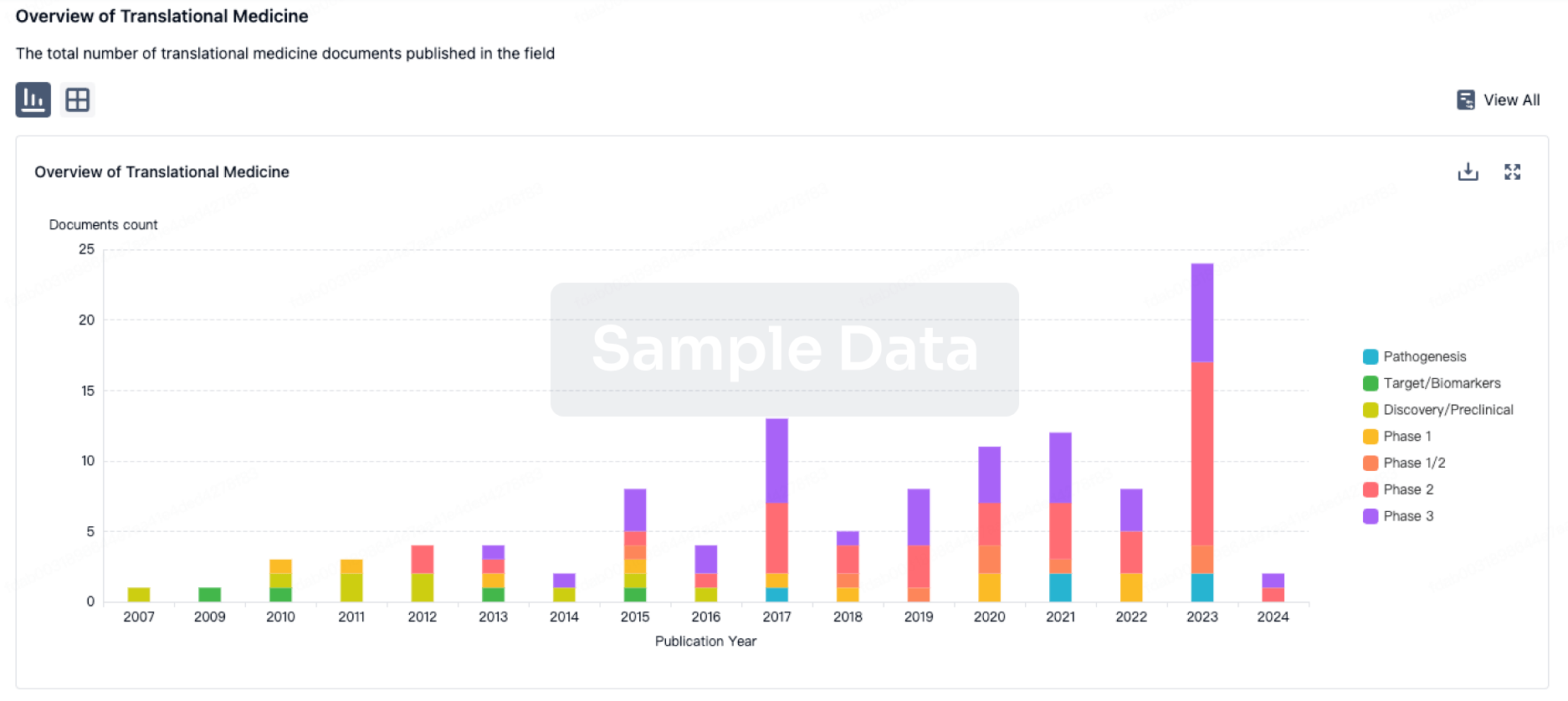

100 Translational Medicine associated with SC276

Login to view more data

100 Patents (Medical) associated with SC276

Login to view more data

1

News (Medical) associated with SC27602 Nov 2022

Expect to file IND this year for SC291 with potential clinical data in 2023 Followed by expected INDs for SG295 and SC276 in 2023 and SC451 in 2024 with potential clinical data in 2024 Q3 2022 cash position of $511.6 million Expect cash runway into 2025 SEATTLE, Nov. 02, 2022 (GLOBE NEWSWIRE) -- Sana Biotechnology, Inc. (NASDAQ: SANA), a company focused on creating and delivering engineered cells as medicines, today reported financial results and business highlights for the third quarter 2022. “Our team is executing well, and 2023 is shaping up to be an important year for the company as we look forward to generating our first data in patients,” said Steve Harr, Sana’s President and Chief Executive Officer. “For SC291, we expect to generate tumor response data and CAR T cell persistence data, which have the potential to highlight differentiation from current CAR T programs and provide generalizable insights on how preclinical results for our hypoimmune platform (HIP) will translate into patients. For SG295, our scientists have developed a second-generation process that is many times more potent and has the potential to lead to better efficacy, safety, and manufacturability. Given the promise and potential of this program, we will take more time to implement these changes and now expect to file the IND in 2023. Our team continues to make meaningful progress across our pipeline and platforms while maintaining a strong balance sheet to fund our lead programs through early clinical development.” Select Program Updates SC291 (HIP-modified CD19-targeted allogeneic CAR T) – We remain on track to file an IND this year. Preclinical data continue to highlight the potential for the HIP platform to hide our allogeneic cells from immune detection, creating the potential for longer CAR T cell persistence and higher durable complete response rates in cancer patients. Additionally, our manufacturing process appears to create, in a replicable fashion, high quality T cells at a scale with the potential for hundreds of doses per batch. We intend to study this therapy in a range of B cell malignancies and report data beginning next year.SG295 (in vivo CAR T with CD8-targeted fusogen delivery of a CD19-targeted CAR) – This program has the potential to generate CAR T cells in vivo (inside the patient), eliminating the need for conditioning chemotherapy and complex CAR T cell manufacturing. We have demonstrated the ability to safely and selectively deliver the CAR gene to T cells in vivo and to generate active CAR T cells in multiple preclinical models. Recently, our scientists have developed a second-generation manufacturing process that results in at least a 50X improvement in product potency, which we believe has the potential to translate into better efficacy, safety, and long-term manufacturability. We have decided to bring this second-generation process forward for our first-in-human studies in patients with B cell malignancies. While implementing this change will delay the IND filing until 2023, we believe the improved process has the potential to provide a better therapy for patients.SC276 (HIP-modified, CD22/CD19-targeted allogeneic CAR T) – We remain on track for an IND in 2023. This program will incorporate the HIP platform, potentially offering greater persistence compared to other allogeneic CAR T therapies, and target CD22 and/or CD19 expressing cells. This therapy has the potential to treat patients with B cell malignancies who have either failed previous CAR T therapies or are naive to CAR T therapy.SC451 (HIP-modified, stem-cell derived pancreatic islet cell therapy for patients with type 1 diabetes) – Preclinical data continue to highlight the potential for HIP modifications to allow these cells to evade both allogeneic and autoimmune rejection in type 1 diabetes. The goal of this therapy is to transplant hypoimmune islet cells with no immunosuppression into patients with type 1 diabetes so that these cells produce insulin in a physiologic manner in response to glucose. We now expect to file our IND in 2024, with early clinical data from this product candidate in 2024. Third Quarter 2022 Financial Results GAAP Results Cash Position: Cash, cash equivalents, and marketable securities as of September 30, 2022 were $511.6 million compared to $746.9 million as of December 31, 2021. The decrease of $235.3 million was primarily driven by cash used in operations of $214.0 million and cash used for the purchase of property and equipment of $16.3 million. Cash used in operations includes $6.2 million of upfront payments related to licensing technology for the company’s CD22 and BCMA programs, $3.2 million of costs incurred related to the previously planned manufacturing facility in Fremont, CA (the Fremont facility) which will be replaced by the Bothell, WA site (the Bothell facility), as well as multiple cash payments that will not recur this year.Research and Development Expenses: For the three and nine months ended September 30, 2022, research and development expenses, inclusive of non-cash expenses, were $76.7 million and $222.0 million, respectively, compared to $53.2 million and $140.1 million for the same periods in 2021. The increases of $23.5 million and $81.9 million, respectively, were largely due to increases in personnel-related expenses increased headcount to expand Sana’s research and development capabilities, increased third-party manufacturing costs, facility and other allocated costs, and research and laboratory costs. For the nine months ended September 30, 2022, the increase was also due to costs to acquire technology. Research and development expenses for the three and nine months ended September 30, 2022 include non-cash stock-based compensation of $7.4 million and $20.6 million, respectively, and $4.1 million and $9.9 million, respectively, for the same periods in 2021.Research and Development Related Success Payments and Contingent Consideration: For the three and nine months ended September 30, 2022, Sana recognized non-cash gains of $6.1 million and $79.4 million, respectively, in connection with the change in the estimated fair value of the success payment liabilities and contingent consideration in aggregate, compared to expenses of $16.8 million and $67.8 million, respectively, for the same periods in 2021. The value of these potential liabilities may fluctuate significantly with changes in Sana’s market capitalization and stock price.General and Administrative Expenses: General and administrative expenses for the three months ended September 30, 2022, inclusive of non-cash expenses, were $15.5 million compared to $13.4 million for the same period in 2021. The increase of $2.1 million was primarily due to operating costs associated with the Fremont facility and stock-based compensation expense. General and administrative expenses for the nine months ended September 30, 2022 were $48.2 million compared to $37.7 million for the same period in 2021. The increase of $10.5 million was primarily due to personnel-related expenses attributable to an increase in headcount to support Sana’s continued research and development activities, the write-off of construction in progress costs incurred in connection with the Fremont facility, and operating costs associated with the Fremont facility. These increases were partially offset by a decrease in legal fees. General and administrative expenses for the three and nine months ended September 30, 2022 include stock-based compensation of $2.6 million and $7.2 million, respectively, and $1.9 million and $5.2 million, respectively, for the same periods in 2021.Net Loss: Net loss for the three and nine months ended September 30, 2022 was $85.1 million, or $0.45 per share, and $189.0 million, or $1.01 per share, respectively, compared to $83.3 million, or $0.46 per share, and $245.2 million, or $1.53 per share, respectively, for the same periods in 2021. Non-GAAP Measures Non-GAAP Operating Cash Burn: Non-GAAP operating cash burn for the nine months ended September 30, 2022 was $219.8 million compared to $146.4 million for the same period in 2021. Non-GAAP operating cash burn is the decrease in cash, cash equivalents, and marketable securities, excluding cash inflows from financing activities, cash outflows from business development activities, and the purchase of property and equipment.Non-GAAP General and Administrative Expense: Non-GAAP general and administrative expense for the three and nine months ended September 30, 2022 was $15.5 million and $43.8 million, respectively, compared to $13.4 million and $37.7 million, respectively, for the same periods in 2021. Non-GAAP general and administrative expense excludes the write-off of construction in progress costs incurred in connection with the Fremont facility.Non-GAAP Net Loss: Non-GAAP net loss for the three and nine months ended September 30, 2022 was $91.2 million, or $0.48 per share, and $264.0 million, or $1.42 per share, respectively, compared to $66.5 million, or $0.37 per share, and $177.4 million, or $1.18 per share, respectively, for the same periods in 2021. Non-GAAP net loss excludes certain one-time costs to acquire technology, non-cash expenses related to the change in the estimated fair value of contingent consideration and success payment liabilities, and the write-off of construction in progress costs incurred in connection with the Fremont facility. A discussion of non-GAAP measures, including a reconciliation of GAAP and non-GAAP measures, is presented below under “Non-GAAP Financial Measures.” About Sana Sana Biotechnology, Inc. is focused on creating and delivering engineered cells as medicines for patients. We share a vision of repairing and controlling genes, replacing missing or damaged cells, and making our therapies broadly available to patients. We are a passionate group of people working together to create an enduring company that changes how the world treats disease. Sana has operations in Seattle, Cambridge, South San Francisco, and Rochester. Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements about Sana Biotechnology, Inc. (the “Company,” “we,” “us,” or “our”) within the meaning of the federal securities laws, including those related to the company’s vision, progress, and business plans; expectations for its development programs, product candidates and technology platforms, including its pre-clinical, clinical and regulatory development plans and timing expectations, including with respect to the expected timing of IND filings for the Company’s product candidates; the Company’s expectations with respect to the potential therapeutic benefits and impact of its development programs; the Company’s expectations regarding the timing, substance, and impact of the data from its clinical trials; the Company’s expected cash runway; potential ability of the Company’s HIP platform to make genomic modifications to allogeneic cells to hide them from immune detection and the potential benefits associated therewith; the potential capabilities of the Company’s manufacturing process for its SC291 program; the potential of the Company’s SG295 program to generate CAR T cells in vivo; the potential advantages of the second-generation manufacturing process for the Company’s SG295 program; the potential ability of the Company’s SC276 program to treat patients with B cell malignancies who have either failed previous CAR T therapies or are naïve to CAR T therapy; and the potential ability of the Company’s HIP platform to make genetic modifications to islet cells to allow them to evade both allogeneic and autoimmune rejection in type 1 diabetes. All statements other than statements of historical facts contained in this press release, including, among others, statements regarding the Company’s strategy, expectations, cash runway and future financial condition, future operations, and prospects, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. The Company has based these forward-looking statements largely on its current expectations, estimates, forecasts and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. These statements are subject to risks and uncertainties that could cause the actual results to vary materially, including, among others, the risks inherent in drug development such as those associated with the initiation, cost, timing, progress and results of the Company’s current and future research and development programs, preclinical and clinical trials, as well as the economic, market and social disruptions due to the ongoing COVID-19 public health crisis. For a detailed discussion of the risk factors that could affect the Company’s actual results, please refer to the risk factors identified in the Company’s SEC reports, including but not limited to its Quarterly Report on Form 10-Q dated November 2, 2022. Except as required by law, the Company undertakes no obligation to update publicly any forward-looking statements for any reason. Investor Relations & Media:Nicole Keithinvestor.relations@sana.commedia@sana.com Sana Biotechnology, Inc.Unaudited Selected Consolidated Balance Sheet Data September 30, 2022 December 31, 2021 (in thousands) Cash, cash equivalents, and marketable securities $511,573 $746,877 Total assets 898,102 1,129,407 Contingent consideration 141,130 153,743 Success payment liabilities 35,710 102,525 Total liabilities 332,083 400,905 Total stockholders' equity 566,019 728,502 Sana Biotechnology, Inc.Unaudited Consolidated Statements of Operations Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 (in thousands, except per share data) Operating expenses:

Research and development $76,735 $53,245 $221,964 $140,121 Research and development related success payments and contingent consideration (6,062) 16,753 (79,428) 67,778 General and administrative 15,514 13,433 48,240 37,731 Total operating expenses 86,187 83,431 190,776 245,630 Loss from operations (86,187) (83,431) (190,776) (245,630)Interest income, net 1,173 158 2,149 409 Other income (expense), net (106) 10 (406) 24 Net loss $(85,120) $(83,263) $(189,033) $(245,197)Net loss per common share - basic and diluted $(0.45) $(0.46) $(1.01) $(1.53)Weighted-average number of common shares - basic and diluted 189,303 181,827 187,645 160,515 Sana Biotechnology, Inc.Changes in the Estimated Fair Value of Success Payments and Contingent Consideration Success PaymentLiability(1) ContingentConsideration(2) Total Success Payment Liability and Contingent Consideration (in thousands) Liability balance as of December 31, 2021 $102,525 $153,743 $256,268 Changes in fair value - gain (54,910) (528) (55,438)Liability balance as of March 31, 2022 47,615 153,215 200,830 Changes in fair value - gain (14,098) (3,830) (17,928)Liability balance as of June 30, 2022 33,517 149,385 182,902 Changes in fair value - expense (gain) 2,193 (8,255) (6,062)Liability balance as of September 30, 2022 $35,710 $141,130 $176,840 Total change in fair value for the nine months ended September 30, 2022 $(66,815) $(12,613) $(79,428) (1) Cobalt Biomedicine, Inc. (Cobalt) and the Presidents of Harvard College (Harvard) are entitled to success payments pursuant to the terms and conditions of their agreements. The success payments are recorded at fair value and remeasured at each reporting period with changes in the estimated fair value recorded in research and development related success payments and contingent consideration on the statement of operations. (2) Cobalt is entitled to contingent consideration upon the achievement of certain milestones pursuant to the terms and conditions of the agreement. Contingent consideration is recorded at fair value and remeasured at each reporting period with changes in the estimated fair value recorded in research and development related success payments and contingent consideration on the statement of operations. Non-GAAP Financial Measures To supplement the financial results presented in accordance with generally accepted accounting principles in the United States (GAAP), Sana uses certain non-GAAP financial measures to evaluate its business. Sana’s management believes that these non-GAAP financial measures are helpful in understanding Sana’s financial performance and potential future results, as well as providing comparability to peer companies and period over period. In particular, Sana’s management utilizes non-GAAP operating cash burn, non-GAAP research and development expense and non-GAAP net loss and net loss per share. Sana believes the presentation of these non-GAAP measures provides management and investors greater visibility into the Company’s ongoing actual costs to operate its business, including actual research and development costs unaffected by non-cash valuation changes and certain one-time expenses for acquiring technology, as well as facilitating a more meaningful comparison of period-to-period activity. Sana excludes these items because they are highly variable from period to period and, in respect of the non-cash expenses, provides investors with insight into the actual cash investment in the development of its therapeutic programs and platform technologies. These are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read in conjunction with Sana’s financial statements prepared in accordance with GAAP. These non-GAAP measures differ from GAAP measures with the same captions, may be different from non-GAAP financial measures with the same or similar captions that are used by other companies, and do not reflect a comprehensive system of accounting. Sana’s management uses these supplemental non-GAAP financial measures internally to understand, manage, and evaluate Sana’s business and make operating decisions. In addition, Sana’s management believes that the presentation of these non-GAAP financial measures is useful to investors because they enhance the ability of investors to compare Sana’s results from period to period and allows for greater transparency with respect to key financial metrics Sana uses in making operating decisions. The following are reconciliations of GAAP to non-GAAP financial measures: Sana Biotechnology, Inc.Unaudited Reconciliation of Change in Cash, Cash Equivalents, and Marketable Securities toNon-GAAP Operating Cash Burn Nine Months Ended September 30, 2022 2021 (in thousands) Beginning cash, cash equivalents, and marketable securities $746,877 $411,995 Ending cash, cash equivalents, and marketable securities 511,573 866,112 Change in cash, cash equivalents, and marketable securities (235,304) 454,117 Cash paid to purchase property and equipment 16,274 24,660 Change in cash, cash equivalents, and marketable securities, excluding capital expenditures (219,030) 478,777 Adjustments:

Cash paid to acquire technology(1) - 1,246 Net proceeds from issuance of common stock(2) (724) (626,405)Operating cash burn - Non-GAAP $(219,754) $(146,382) (1) The non-GAAP adjustment of $1.2 million for the nine months ended September 30, 2021 was the holdback payment related to the acquisition of Cytocardia, Inc. in 2019.(2) Net proceeds of $0.7 million were received in connection with the at the market sales agreement in the nine months ended September 30, 2022. Sana Biotechnology, Inc.Unaudited Reconciliation of GAAP to Non-GAAP General and Administrative Expense Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 (in thousands) General and administrative - GAAP $15,514 $13,433 $48,240 $37,731 Adjustments:

Write-off of construction in progress costs incurred in connection with the previously planned Fremont facility(1) - - (4,474) - General and administrative - Non-GAAP $15,514 $13,433 $43,766 $37,731 (1) The Fremont facility will be replaced with the Bothell facility. Sana Biotechnology, Inc.Unaudited Reconciliation of GAAP to Non-GAAP Net Loss and Net Loss Per Share Three Months EndedSeptember 30, Nine Months EndedSeptember 30, 2022 2021 2022 2021 (in thousands, except per share data) Net loss - GAAP $(85,120) $(83,263) $(189,033) $(245,197)Adjustments:

Change in the estimated fair value of the success payment liabilities(1) 2,193 25,229 (66,815) 57,698 Change in the estimated fair value of contingent consideration(2) (8,255) (8,476) (12,613) 10,080 Write-off of construction in progress costs incurred in connection with the previously planned Fremont facility3) - - 4,474 - Net loss - Non-GAAP $(91,182) $(66,510) $(263,987) $(177,419)Net loss per share - GAAP $(0.45) $(0.46) $(1.01) $(1.64)Adjustments:

Change in the estimated fair value of the success payment liabilities(1) 0.01 0.14 (0.36) 0.39 Change in the estimated fair value of contingent consideration(2) (0.04) (0.05) (0.07) 0.07 Write-off of construction in progress costs incurred in connection with the previously planned Fremont facility(3) - - 0.02 - Net loss per share - Non-GAAP $(0.48) $(0.37) $(1.42) $(1.18)Weighted-average shares outstanding - basic and diluted 189,303 179,899 187,645 149,683 (1) For the three months and nine ended September 30, 2022, the change in the estimated fair value related to the Cobalt success payment liability was an expense of $2.4 million and a gain of $56.5 million, respectively, compared to expenses of $21.8 million and $46.9 million for the same periods in 2021. For the three months and nine ended September 30, 2022, the gains related to the Harvard success payment liability were $0.2 million and $10.3 million, respectively, compared to expenses of $3.4 million and $10.8 million for the same periods in 2021.(2) The contingent consideration was recorded in connection with the acquisition of Cobalt. (3) The Fremont facility will be replaced with the Bothell facility.

Financial StatementCell TherapyAcquisition

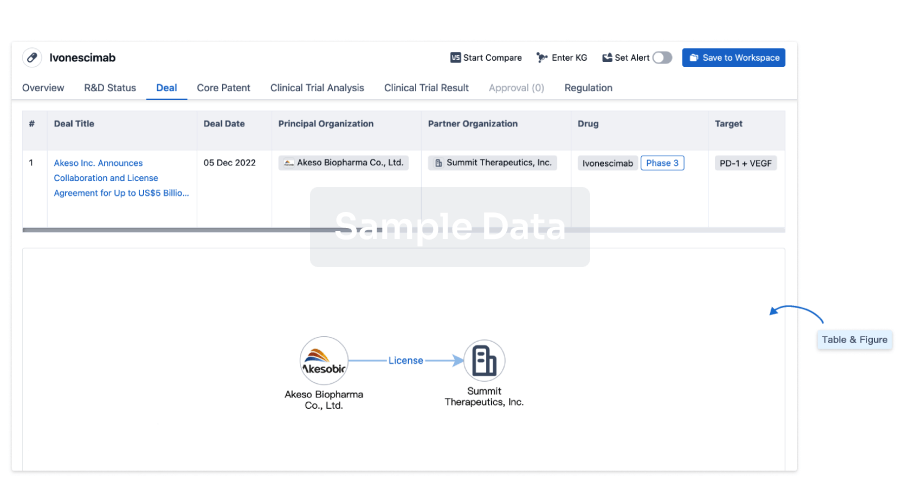

100 Deals associated with SC276

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

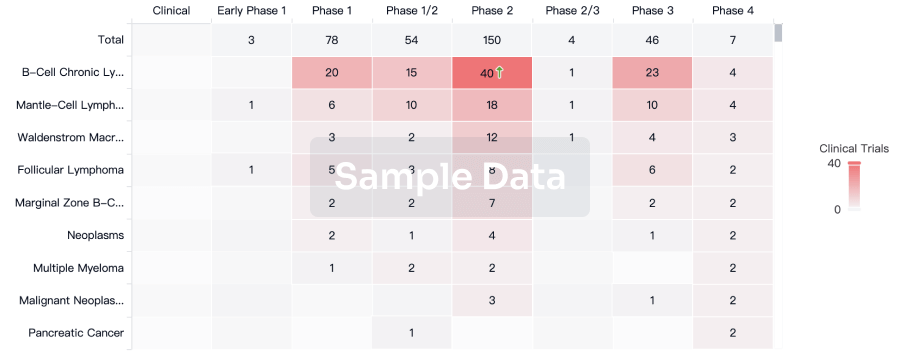

| Acute Lymphoblastic Leukemia | Preclinical | US | - | |

| Chronic Lymphocytic Leukemia | Preclinical | US | - | |

| Non-Hodgkin Lymphoma | Preclinical | US | - |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

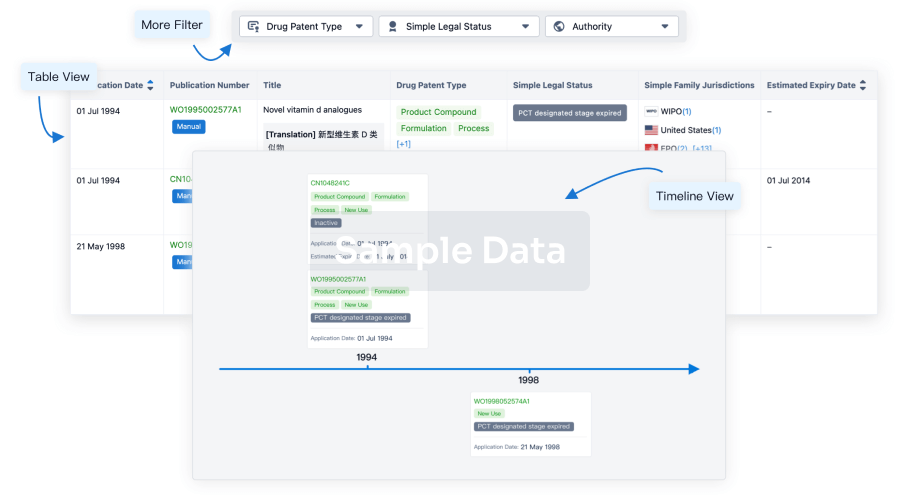

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

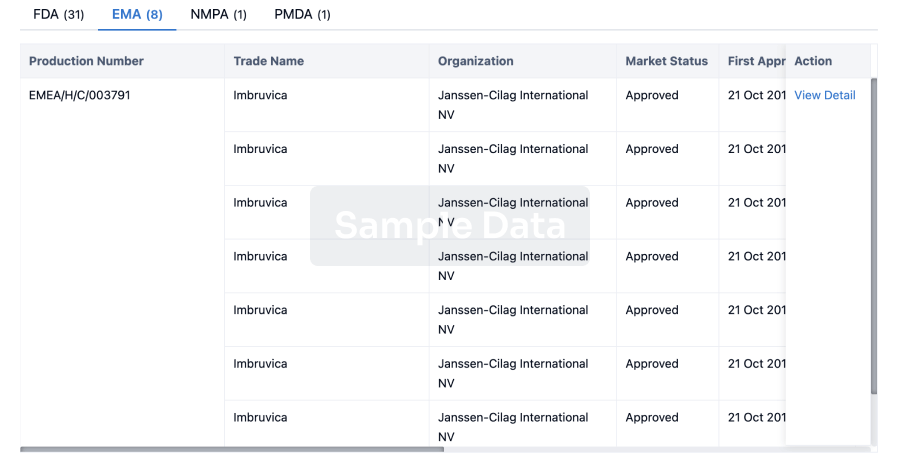

Approval

Accelerate your research with the latest regulatory approval information.

login

or

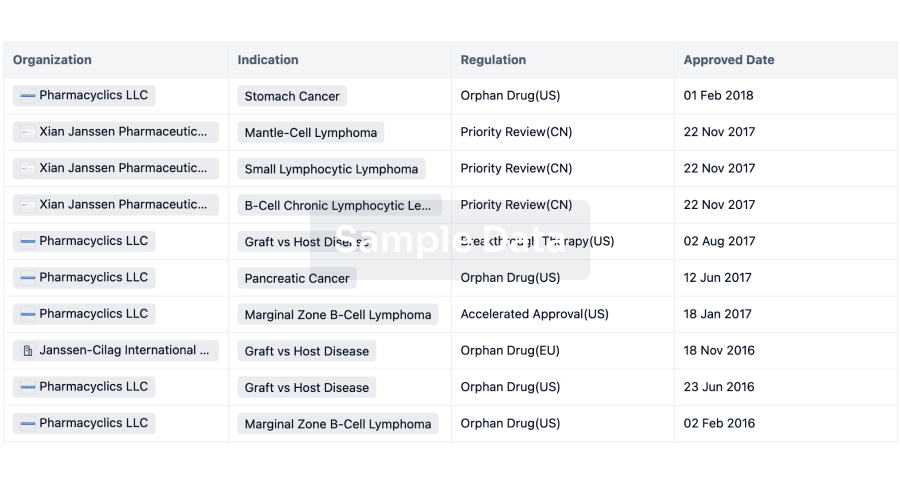

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

Chat with Hiro

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free