Request Demo

Last update 23 Jan 2025

BJT-574

Last update 23 Jan 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms |

Target |

Mechanism HBsAg inhibitors(HBsAg inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization  Bluejay Therapeutics, Inc.Startup Bluejay Therapeutics, Inc.Startup |

Drug Highest PhasePreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with BJT-574

Login to view more data

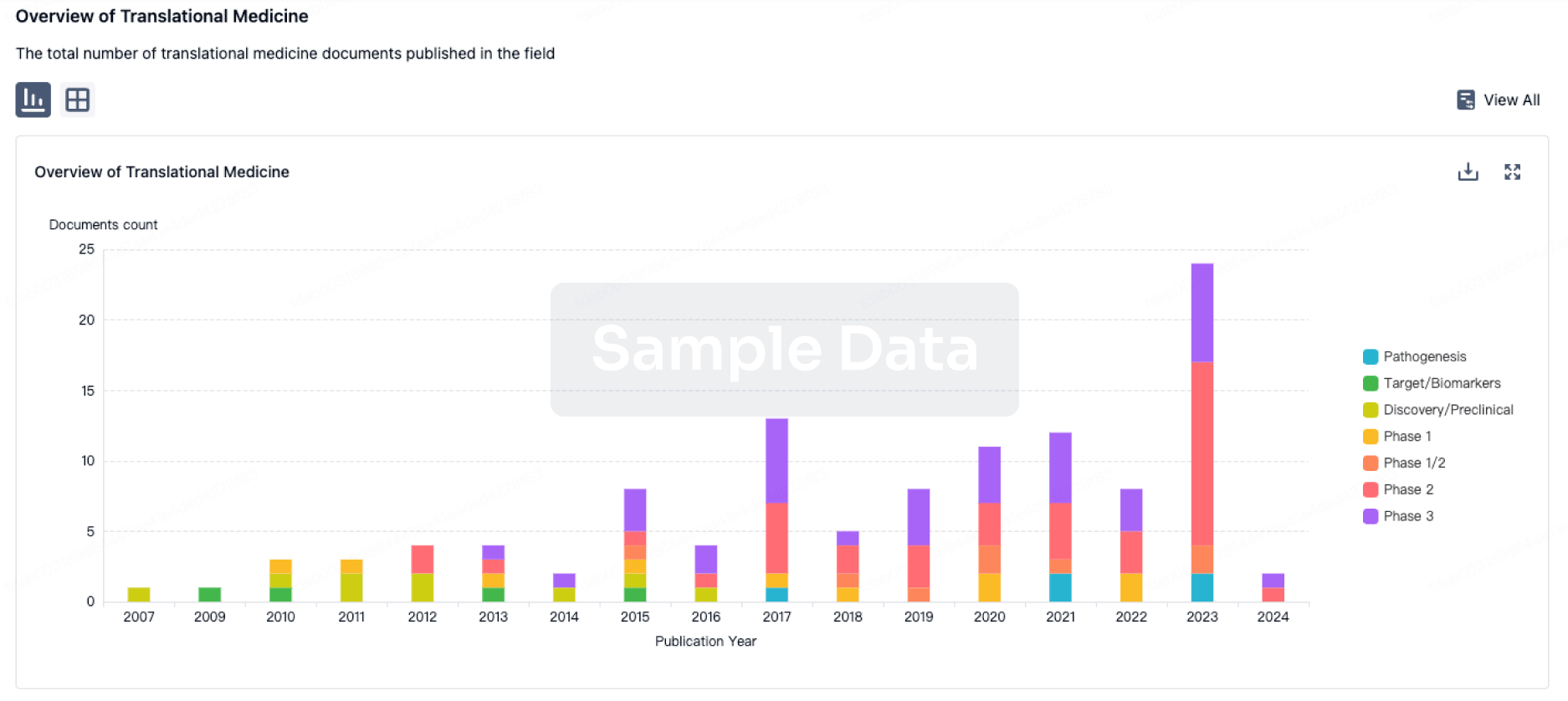

100 Translational Medicine associated with BJT-574

Login to view more data

100 Patents (Medical) associated with BJT-574

Login to view more data

4

News (Medical) associated with BJT-57424 Aug 2022

Funding rounds in mid-August threw support behind promising companies worldwide, and money is now flowing into platforms for prostate cancer, mRNA therapeutics, hepatitis and depression.

“Revolutionary” Metastatic Prostate Cancer Candidate Earns AdvanCell $12M in Series B

Sydney, Australia-based AdvanCell closed its Series B financing round, counting more than $12 million in earnings. These funds will go to its proprietary platform, Targeted Alpha Therapy, which combines highly-specific targeting molecules with naturally decaying radioisotopes to deliver radiotherapy straight to a tumor.

The lead candidate out of this platform, 212Pb-ADVC001, is a best-in-class compound for metastatic prostate cancer. Proceeds from AdvanCell’s Series B round will also help accelerate the candidate through to the clinics.

To further support its Targeted Alpha Therapy platform, the radiopharmaceutical company is strengthening its capacity for on-demand isotope production. AdvanCell has developed the world’s first scalable manufacturing platform for alpha-emitting isotopes, thanks to additional funding from various government initiatives.

Next-Gen mRNA Manufacturing Gets $39M in Series B2 for eTheRNA

The recently-concluded Series B2 round of funding has earned eTheRNA Immunotherapies nearly $39M, which the company plans to use to further expand and develop its mRNA-based platforms.

Since its founding in 2013, the Belgian biotech has honed its proprietary processes for designing, developing and manufacturing what it calls “next-generation mRNA products.” With the help of these Series B2 proceeds, eTheRNA looks to move into a partnership-driven business strategy, which will see the company deliver high-quality products, such as T cell adjuvants and customized lipid nanoparticle formulations, to a wide range of partners across the entire spectrum of drug development.

The current financing round was led by the investment firm Novalis LifeSciences and counted among its participants Prof. Kenneth Chien, renowned mRNA expert and co-founder of Moderna Therapeutics. Chien is joining eTheRNA’s board of directors, while the company’s current COO, Bernard Sagaert, will serve as its interim CEO.

Freedom Biosciences Exits Stealth Mode with $10.5M Seed Round

Mental health start-up Freedom Biosciences emerged from its state of secrecy, touting $10.5 million in seed financing from MBX Capital, PsyMed Ventures, Village Global and others. The proceeds will help the fledgling firm get its lead ketamine program off the ground.

Freedom’s flagship program is dubbed FREE001, which is a ketamine-based treatment regimen for people with major depressive disorder. In preclinical studies, FREE001 demonstrated more durable benefits than ketamine alone. In a Phase II investigational study, Freedom’s combination approach induced an antidepressant effect up to three times longer than monotherapy.

Backing Freedom’s ketamine program are some industry heavy-hitters: John Krystal, the chairperson of the department of psychiatry at Yale University, is serving as the company’s chief scientific officer. Dina Burkitbayeva, one of the pioneering investors in the therapeutic psychedelics space, is its chief executive. Freedom will also use its seed fund to power other exploratory programs.

Windtree’s Pipeline Attracts Two Chinese Firms in $80M Deal

Pennsylvania biotech Windtree Therapeutics has entered into a $78.9-million deal with Hong Kong-based Lee’s Pharmaceutical and its China affiliate, Zhaoke Pharmaceutical. At the core of the agreement are Windtree’s pulmonary pipeline treatments, particularly the KL4 surfactant and the drug-device combination AEROSURF, both for respiratory distress syndrome in preterm infants.

Lee and Zhaoke had previously won a regional license for KL4 and AEROSURF, paying an upfront $1 million for rights to Windtree’s pipeline products in the Greater China area. This week’s deal expands that coverage globally. In turn, the Asian companies will assume all funding responsibility over development, manufacturing, commercialization and intellectual property activities, while Windtree will remain entitled to commercial milestones and potential double-digit royalties.

After its execution, the agreement will conclude all of Windtree’s ongoing maintenance and operating costs for KL4.

$80M Series B Fuels Chinese CDMO’s Global Quest

Chinese firm Porton Advanced Solutions closed its Series B financing round this week, raising more than $80 million. These funds will help Porton establish itself as a globally competitive end-to-end gene and cell therapy (GCT) contract development and manufacturing company. The company also plans on using the proceeds to bolster its core manufacturing facilities and expand into new markets.

Porton’s business is focused on the GCT space, producing plasmids, oncolytic viruses, nucleic acid therapies, vectors and other reagents needed in GCT work. The company currently has an operational footprint of 40,000 square feet dedicated for R&D and manufacturing but plans to add 160,000 square feet more by the end of this year or early 2023, meant for commercial production. This will take Porton to a total of ten viral vectors and ten cell therapy production lines, and hundreds of clean rooms.

PanTher Wins $14.2M to Support Localized, Sustained Pancreatic Cancer Therapeutic

The Cancer Prevention and Research Institute of Texas (CPRIT) has awarded Massachusetts-based, cancer-focused company PanTher Therapeutics with a $14.2-million grant to support the development of PTM-101, PanTher’s lead investigational drug for pancreatic cancer.

PTM-101, the lead compound out of PanTher’s proprietary Sagittari platform, is a minimally invasive implant meant to consistently deliver a known drug directly to the tumor site. This sustained-release approach is currently in Phase I assessments for patients with non-metastatic disease.

PanTher plans on using CPRIT’s grant to fund PTM-101’s development through Phase II studies and further improve upon its Sagittari platform, which it hopes could add more innovative localized cancer candidates to its pipeline.

Bluejay Deepens Leadership Bench, Secures $41M in Series B for Chronic Hepatitis Trials

With its Series B round of financing recently completed, San Francisco’s Bluejay Therapeutics now has $41 million in the bank to fund its hepatitis programs. Primarily, the privately-held biopharma plans to channel these proceeds into its lead candidate BJT-778, a human monoclonal antibody against the hepatitis B virus surface antigen (HBsAg). BJT-778 is set for a proof-of-concept study in patients with chronic infections.

Bluejay will also allot some of its Series B earnings for the first-in-human trials of BJT-574, an oral small-molecule inhibitor of HBsAg.

Alongside the completion of its Series B funding, the California company welcomed new additions to its leadership roster: William J. Rutter, chairman and CEO of Synergenics LLC, Alon Lazarus, investment manager with Arkin Bio Ventures and Ting Jia, founder and chief investment officer of Octagon capital. All three will serve on Bluejay’s board of directors.

AntibodyCell TherapymRNA

17 Aug 2022

Every year, 820,000 people die of chronic hepatitis B infections globally, and 1.5 million get infected, despite the availability of vaccines and treatments, according to the CDC. Current standard-of-care treatments can be effective in stopping virus replication, but they require patients to be on meds for life.

Bluejay Therapeutics, which was founded in 2019, is trying to change that, aiming to develop a functional cure for hepatitis B infections by making HBsAg — viral protein-surface antigens — completely undetectable within six months of treatment. And it’s got a new round of cash to try making it a reality.

The company

closed a $41 million Series B

round Tuesday led by Arkin Bio Ventures. This round included participation from other new and existing investors, including Synergenics LLC, RiverVest Venture Partners, Yonjin Capital, Octagon Capital and InnoPinnacle International.

“Vaccines are available but not everyone has access to it. For instance, the UK health system does not even cover it,” said Keting Chu, Bluejay’s founder and CEO. “When patients stop taking medicine, the virus rebounds,” Chu added.

Even when patients are on meds, their bodies continue to make HBsAg, which causes chronic inflammation that eventually leads to liver cirrhosis and cancer.

These HBsAg antigens, when produced in the body, cause “exhaustion” of the immune system, specifically the B cell and T cell, said Chu. Bluejay’s lead asset is BJT-778, an antibody against HBsAg antigens, which the company has licensed from Novartis.

“The goal is to restore T cell and B cell functions to get immune control and achieve a functional cure,” Chu said.

Funding from this round will support the clinical development of BJT-778, a human anti-HBsAg monoclonal antibody, to demonstrate proof-of-concept in chronic hepatitis B patients. It will also fund the development of BJT-574, an orally bioavailable small molecule HBsAg inhibitor, into first-in-human clinical trials, the company said.

The hepatitis B virus is mostly transmitted from mother to child during birth and delivery, as well as through contact with blood or other bodily fluids during sex with an infected partner, unsafe injections or exposure to sharp instruments. Once in the body, it causes chronic infection and puts people at high risk of death from cirrhosis and liver cancer.

Currently, there are seven drugs approved in the US for patients with chronic hepatitis B infection. These include five types of antiviral drugs that are taken as a pill once a day for one year or longer. And there are two types of immune modulator drugs, called “interferon,” that are given as an injection for six months to one year. Some of the major producers of these drugs include Gilead, GSK, Bristol Myers Squibb and Novartis.

VaccineAntibodySmall molecular drugCollaborate

17 Aug 2022

SAN MATEO, Calif., Aug. 16, 2022 (GLOBE NEWSWIRE) -- Bluejay Therapeutics announced today that it has closed a $41 million Series B round of finance led by Arkin Bio Ventures. This round includes participation from other new and existing investors including Synergenics LLC, RiverVest Venture Partners, Yonjin Capital, Octagon Capital and InnoPinnacle International.

Bluejay Therapeutic is a virology and liver disease-based company with two advanced preclinical programs that are focused on the reduction of HBsAg load and the reconstitution of antiviral immunity aiming to achieve a functional cure for chronic HBV infection (CHBV).

Funding from this round will support the clinical development of the lead program, BJT-778, a human anti-HBsAg monoclonal antibody, to demonstrate proof-of-concept in CHBV patients. It will also fund development of BJT-574, an orally bioavailable small molecule HBsAg inhibitor, into first-in-human clinical trials.

Within the last year, Bluejay has achieved a number of significant milestones including the initiation of the IND-enabling studies for the lead asset BJT-778. In addition, Bluejay strengthened its leadership by recruiting Dr. Nancy Shulman as Chief Medical Officer and further bolstered the clinical team with Carole Ann Moore and Dr. Simon Ducher as the heads of clinical operation and regulatory affairs, respectively.

With the completion of the Series B financing, Bluejay is welcoming Dr. William J. Rutter, the Chairman and CEO of Synergenics LLC, Dr. Alon Lazarus, Investment Manager at Arkin Bio Ventures and Dr. Ting Jia, founder and chief investment officer at Octagon Capital, to its board of directors.

“Bill and Alon’s extensive experience across therapeutic areas will be invaluable to Bluejay at this time of growth for our company. We are very excited to have them on the team," said Dr. Keting Chu, Founder, Chairman of the Board and CEO of Bluejay Therapeutics.

“In light of the recent developments and the exciting data in the field of HBV, we believe Bluejay is well positioned to contribute significantly in the pursuit of regimens that will generate functional cures in CHBV patients. We look forward to generating clinical data soon and are excited to support Bluejay’s excellent team.” Said Dr. Alon Lazarus, Investment Manager at Arkin Bio Ventures.

“RiverVest looks forward to continuing our support of Keting’s fantastic team at Bluejay as we enter the clinic in an area of high unmet medical need. We welcome the expertise and thoughtfulness of our new Board members as we reach important clinical milestones,” said Dr. Nancy Hong, Managing Director at RiverVest.

About Bluejay’s Pipeline

Bluejay Therapeutics has two lead programs that are focused on the reduction of HBsAg load and the reconstitution of an antiviral immune response to achieve a functional cure for chronic HBV infection (CHBV). BJT-778, a best-in-class human anti-HBsAg monoclonal antibody, has demonstrated rapid depletion of peripheral HBsAg in vivo in a mouse model of chronic HBV infection showing great potential to be a critical component of CHBV curative therapies. BJT-574, a potential best-in-class oral small molecule HBsAg inhibitor, can effectively reduce HBsAg production from HBV-infected hepatocytes and is expected to be an effective partner for BJT-778 as a compelling new combination approach to a functional cure for CHBV.

About Bluejay Therapeutics

Bluejay Therapeutics is a private biopharmaceutical company focused on the development of cures for infectious diseases. The company’s first target indication is chronic Hepatitis B, which remains a worldwide prevalent disease with urgent unmet medical need. BlueJay is advancing two innovative approaches with the potential for high rate of functional cure: best-in-class fully human IgG1 anti-HBs monoclonal antibodies and potential best-in-class HBsAg oral small molecule inhibitors. The company believes that by reducing hepatitis B surface antigen and restoring adaptive immunity a functional cure could be achieved for patients. For more information on BlueJay, please visit the company’s website at www.bluejaytx.com.

AntibodySmall molecular drug

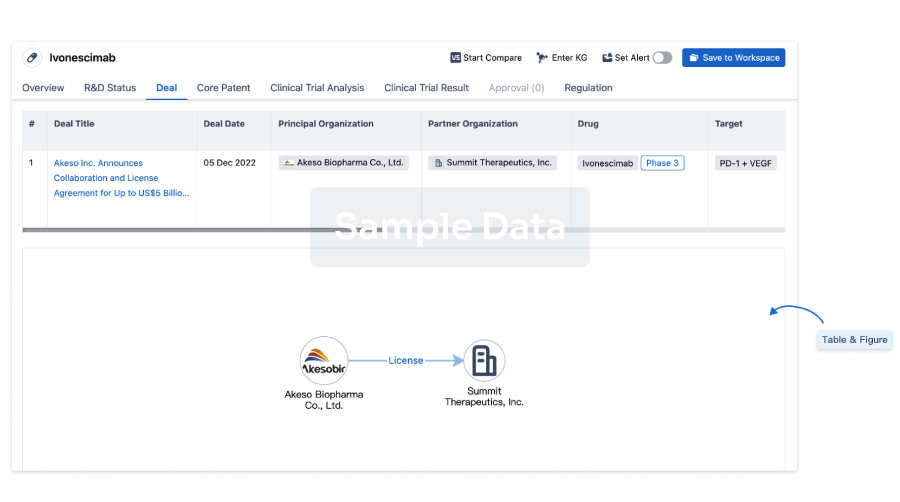

100 Deals associated with BJT-574

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Hepatitis B | Preclinical | US | - | |

| Hepatitis B | Preclinical | US |  Bluejay Therapeutics, Inc.Startup Bluejay Therapeutics, Inc.Startup | - |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

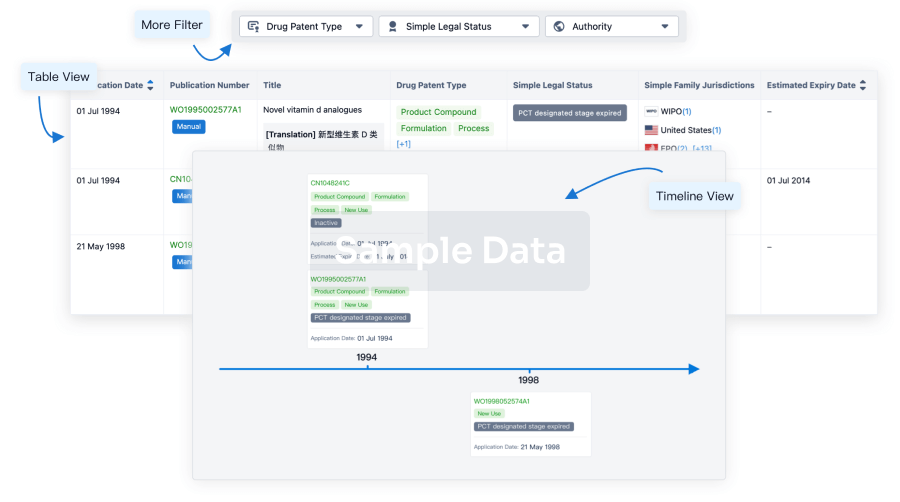

Core Patent

Boost your research with our Core Patent data.

login

or

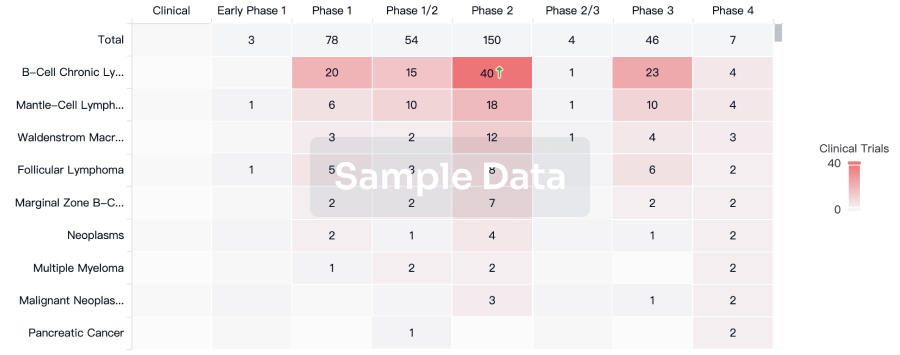

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

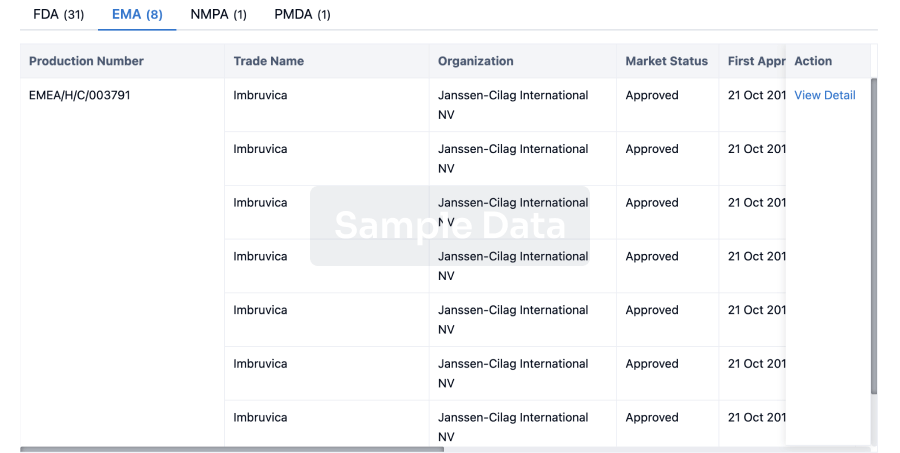

Approval

Accelerate your research with the latest regulatory approval information.

login

or

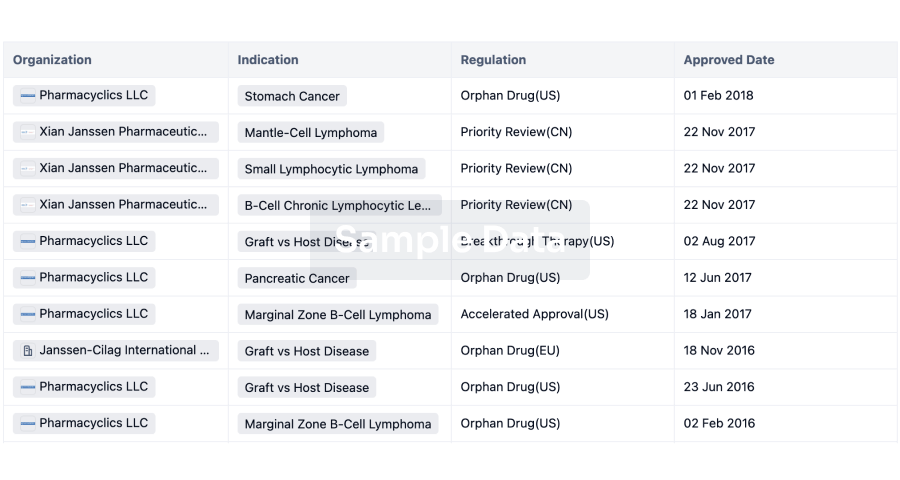

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

Chat with Hiro

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free