Request Demo

Last update 08 May 2025

Lyophilised haemostat platelet derivatives (Cellphire)

Last update 08 May 2025

Overview

Basic Info

Drug Type Cell therapy |

Synonyms Freezedried platelets Cellphire, Thrombosomes |

Target- |

Action stimulants |

Mechanism Blood coagulation stimulants, Cell replacements |

Therapeutic Areas |

Active Indication |

Inactive Indication |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization- |

Drug Highest PhasePhase 2 |

First Approval Date- |

RegulationOrphan Drug (United States) |

Login to view timeline

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Hemorrhage | Phase 2 | Denmark | 15 Mar 2023 | |

| Thrombocytopenia | Phase 2 | Denmark | 15 Mar 2023 | |

| Anemia, Aplastic | Preclinical | United States | 19 Mar 2018 | |

| Anemia, Aplastic | Preclinical | Norway | 19 Mar 2018 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

Phase 2 | 28 | (gznunyxnwl) = mntyuxmsfy qyqkvuycqs (aiwiwfiuym ) View more | - | 02 Jun 2022 | |||

(gznunyxnwl) = vsucjqzrmf qyqkvuycqs (aiwiwfiuym ) View more | |||||||

Phase 2 | 7 | (xfybtfmfbn) = The TEAE profile was consistent with the underlying disease and known AE profiles of pembro, NMA ~ LD and IL ~ 2. flcfuajebc (fhashmuouz ) View more | Positive | 28 May 2021 |

Login to view more data

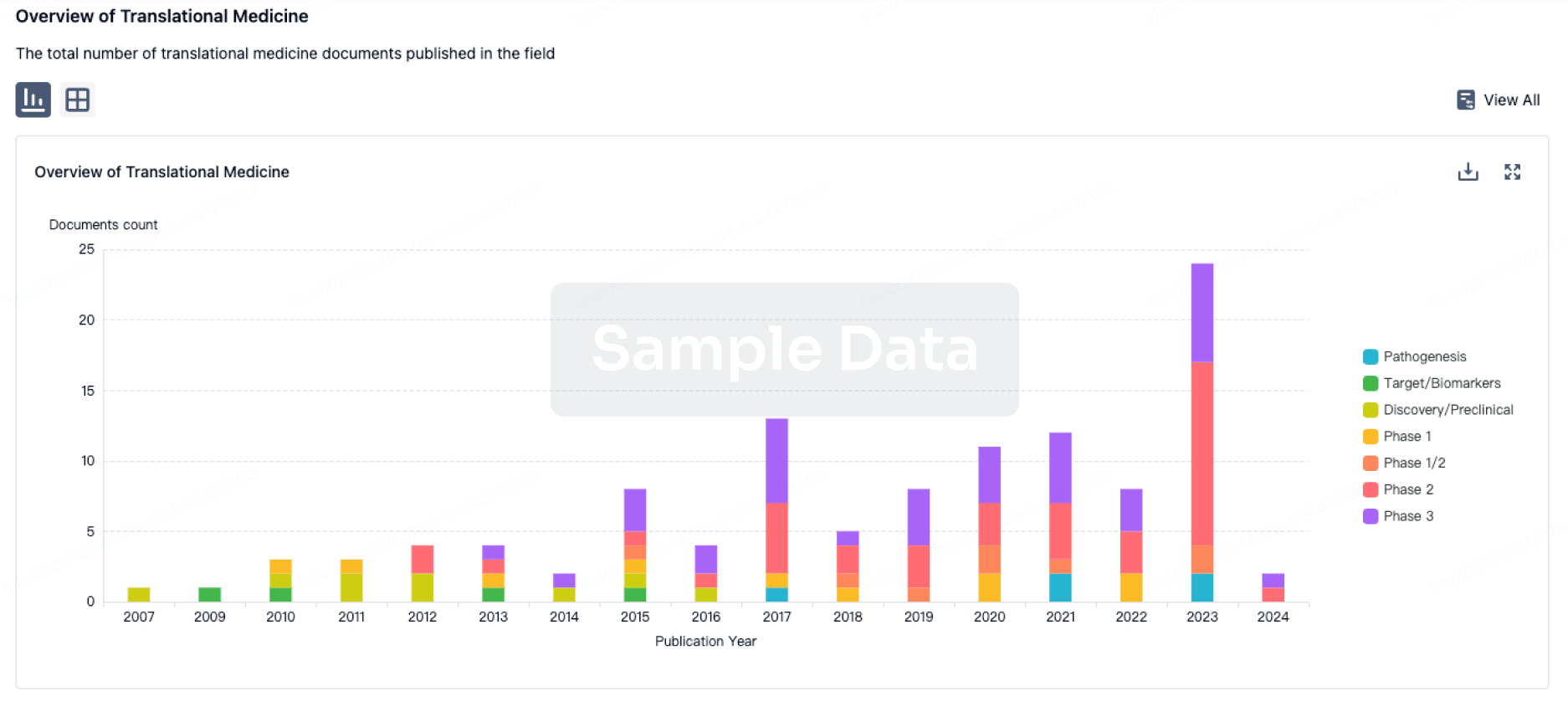

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

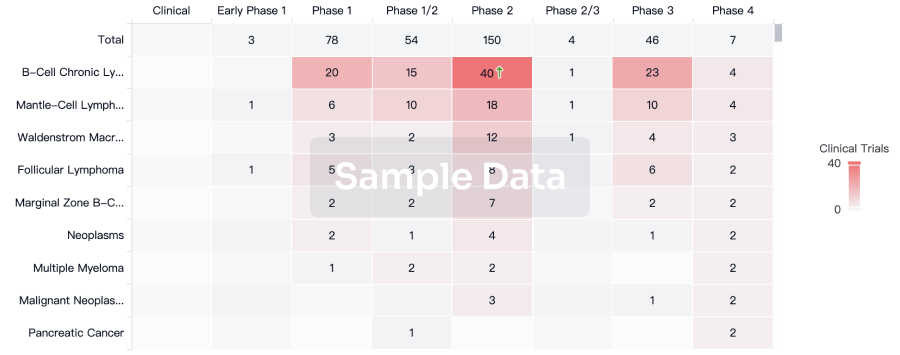

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

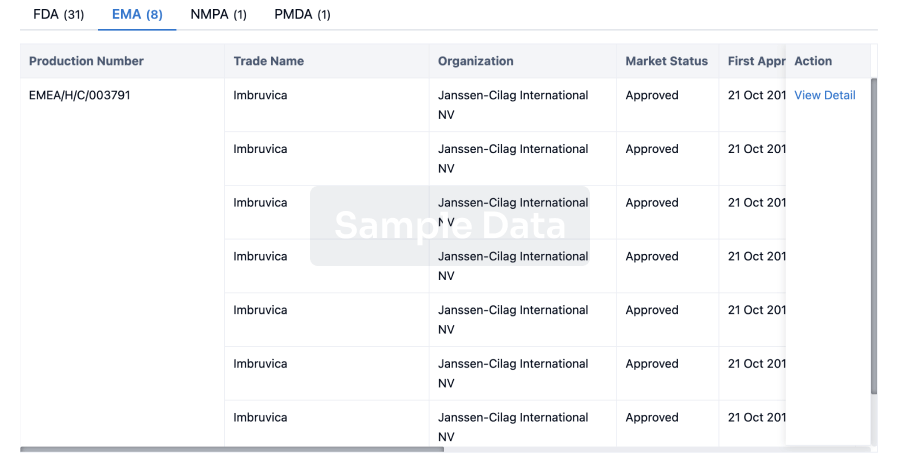

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free